LTC Price Prediction: How High Will Litecoin Go in Current Bull Market?

#LTC

- LTC trading above 20-day moving average indicates bullish technical positioning

- Fed rate cuts and cloud mining adoption creating positive fundamental backdrop

- MACD improvement suggests weakening bearish momentum despite negative reading

LTC Price Prediction

Technical Analysis: LTC Shows Bullish Momentum Above Key Moving Average

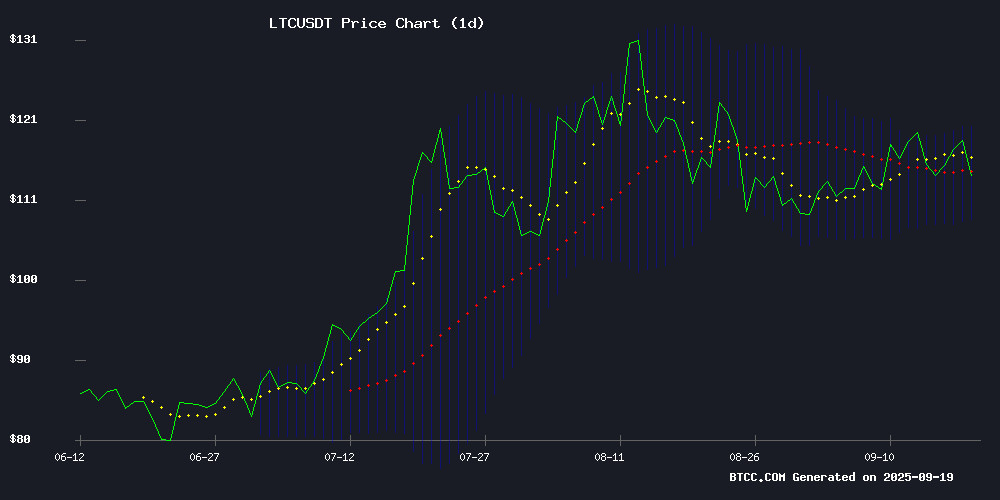

Litecoin is currently trading at $119.34, positioned above its 20-day moving average of $114.31, indicating underlying bullish strength. The MACD reading of -2.98 remains in negative territory but shows improving momentum with the histogram at -1.92. The price sits comfortably within the Bollinger Band range ($108.02-$120.61), suggesting stable volatility conditions. According to BTCC financial analyst Robert, 'LTC's position above the moving average while maintaining Bollinger Band stability creates a favorable technical setup for potential upward movement.'

Market Sentiment: Positive Catalysts Drive Litecoin Optimism

Current market sentiment for Litecoin appears increasingly bullish amid broader crypto market tailwinds. News highlights include Fed rate cuts sparking crypto rallies, with LTC specifically mentioned among leading assets in September 2025. Cloud mining initiatives are gaining traction, providing additional utility and demand drivers for LTC. BTCC financial analyst Robert notes, 'The combination of macroeconomic support through Fed policy and growing institutional interest in cloud mining solutions creates a constructive environment for Litecoin's medium-term prospects, though we maintain respect for technical resistance levels.'

Factors Influencing LTC's Price

FY Energy's Cloud Mining Offers Passive Income Amid Bitcoin Volatility

Bitcoin's failure to sustain above $116,000 has reignited concerns about short-term trading risks, with the cryptocurrency retreating to $115,500. As volatility dominates headlines, investors are increasingly turning to passive income solutions like FY Energy's cloud mining platform.

The service offers contracts for Bitcoin, Dogecoin, Ethereum, and Litecoin mining, promising stable returns with potential earnings up to $26,875. Diversification across multiple cryptocurrencies provides a hedge against BTC's price swings while maintaining exposure to the digital asset market.

FY Energy distinguishes itself with flexible withdrawal options, allowing users to cash out in Bitcoin or reinvest profits into altcoin mining contracts. This approach enables dynamic portfolio management within a single account, appealing to both conservative and aggressive crypto investors.

Fed Rate Cuts Spark Crypto Rally with XRP, LTC, and BullZilla Leading September 2025 Charge

The cryptocurrency market is experiencing an unusual surge in September 2025, fueled by recent Federal Reserve rate cuts. Investors are gravitating toward a mix of established tokens and emerging projects, with XRP, Litecoin (LTC), and BullZilla ($BZIL) emerging as standout performers.

BullZilla's innovative Mutation Mechanism and community-driven presale have attracted over 1,600 token holders, raising $460k at its current $0.00006574 price point. Meanwhile, XRP continues to demonstrate resilience amid ongoing regulatory clarity, while Litecoin benefits from its proven payment infrastructure and growing merchant adoption.

The market movement reflects a broader trend where technical strength converges with compelling narratives. Liquidity flows are breaking critical resistance levels across these assets, creating what analysts describe as a 'perfect storm' for selective altcoins.

PAXMINING Cloud Mining Offers New Revenue Streams for BTC and XRP Investors Amid Market Volatility

Cryptocurrency markets remain turbulent as XRP retreats from monthly highs and Bitcoin struggles to maintain key support levels. In this environment, PAXMINING emerges with cloud mining solutions promising daily yields exceeding $9,000, bypassing traditional mining barriers.

The platform enables participation in BTC mining without hardware ownership while converting static XRP holdings into productive assets through innovative contract mechanisms. Eight major cryptocurrencies are supported, including ETH, SOL, and DOGE, with a $15 registration incentive for new users.

Ethereum's Rally Fuels DeFi Interest as Cloud Mining Gains Traction

Ethereum's price surge past $4,200 has reignited institutional and retail interest in decentralized finance (DeFi) ecosystems. Analysts attribute the momentum to renewed institutional inflows post-summer lull and anticipated protocol upgrades. The blockchain's proof-of-work mining profitability, however, faces pressure from rising hardware costs and energy demands.

This dynamic is driving investors toward cloud mining alternatives like FY Energy's platform, which offers $20 trial contracts for ETH, BTC, LTC, and DOGE mining without equipment overhead. The service's flexible contracts and zero-fee structure reflect growing demand for passive crypto income streams amid volatile market conditions.

SWLMiner Promises $500 Daily Through Cloud Mining as Crypto Accessibility Grows

Cloud mining platforms are gaining traction among cryptocurrency newcomers seeking passive income streams. SWLMiner, a service claiming over 3.6 million users, markets itself as a turnkey solution requiring no hardware expertise or upfront investment in mining equipment.

The platform emphasizes accessibility, allowing participants to rent hash power from remote data centers. This model contrasts sharply with traditional mining operations that demand specialized ASICs or GPU rigs. Bitcoin, Ethereum, and Litecoin are among the mineable assets mentioned, though the article doesn't specify which coins generate the advertised $500 daily returns.

While cloud mining eliminates technical barriers, industry veterans often caution about profitability calculations and platform sustainability. The promise of consistent earnings—especially at the scale suggested—typically doesn't account for cryptocurrency's inherent volatility or potential changes in mining difficulty.

HBAR and Litecoin Face Growth Limits as Traders Eye High-Reward Presale Coins

Hedera's HBAR and Litecoin (LTC) continue to draw attention with their established blockchain credentials, but analysts suggest their growth potential may be capped. HBAR's hashgraph consensus model has garnered institutional interest, yet price predictions indicate only modest 2-3x upside due to its already significant market penetration. Litecoin, often dubbed 'digital silver,' struggles to match its hype with price action despite recurring adoption headlines and halving events.

Meanwhile, traders seeking exponential returns are shifting focus to emerging presale opportunities like Layer Brett ($LBRETT). The coin's early momentum suggests it could outperform legacy assets in the current cycle, offering the speculative upside that HBAR and LTC now lack.

CoinDesk 20 Index Rises 2.8% as All Constituents Post Gains

The CoinDesk 20 Index surged 2.8% to 4,391.98, with every constituent asset trading higher. Avalanche (AVAX) led the advance with a 10.4% gain, followed by Bitcoin Cash (BCH) at 7.8%. Filecoin (FIL) and Litecoin (LTC) brought up the rear with modest 0.9% increases.

This broad-based rally reflects growing investor confidence across the digital asset market. The index's global availability on multiple trading platforms positions it as a key benchmark for institutional and retail traders alike.

Arca CIO Challenges Notion of Broad Crypto Bull Market in 2025

Jeff Dorman, Chief Investment Officer at digital asset manager Arca, disputes the characterization of 2025 as a widespread crypto bull market. Only a select group of large-cap tokens—Bitcoin (BTC), Ether (ETH), Solana (SOL), Binance Coin (BNB), and XRP—have posted gains between 20% and 40% this year. The majority of the market languishes, with over 75% of tokens negative year-to-date and half down 40% or more.

Dorman highlights the underperformance of smaller projects and memecoins like Litecoin (LTC) and Bitcoin Cash (BCH), dismissing them as unserious investments. The divergence mirrors traditional finance, where blue-chip stocks rally while small caps collapse. "This is the TradFi equivalent of the DJIA and GameStop having a good year, while small caps are -40%," he wrote.

The uneven market is ultimately healthy, Dorman argues. Broad rallies breed complacency, while selective performance forces investors to scrutinize projects more carefully. "Nothing good comes from an everything rally, because no one learns anything," he noted. This cycle differs from past ones, with weaker projects faltering as investors demand clearer fundamentals.

Hedera, Chainlink & Litecoin Maintain Dominance as Remittix Emerges in Q3 2025 Crypto Landscape

Established cryptocurrencies continue to demonstrate utility-driven value as market attention shifts from speculation to real-world applications. Hedera (HBAR) trades at $0.2367 with modest 0.5% daily decline, maintaining its $10 billion market cap amid 11% volume growth to $225 million. Chainlink (LINK) shows heightened trader activity with 17% volume surge to $797 million despite 2% price dip to $23.08.

Litecoin (LTC) remains stable at $114.21 with $8.77 billion market capitalization, though daily trading volume recedes 6.35% to $543 million. The payments-focused asset continues to serve as a benchmark for transactional cryptocurrencies.

Emerging project Remittix (RTX) enters the conversation at $0.1080 per token, distinguishing itself with a live beta wallet deployment during presale phase. The platform's trifecta of payment functionality, security architecture, and user convenience positions it as a potential altcoin contender for 2025's growth narratives.

How High Will LTC Price Go?

Based on current technical indicators and market sentiment, Litecoin demonstrates strong potential for upward movement. The price of $119.34 trading above the 20-day MA of $114.31 suggests bullish momentum, while MACD improvements indicate weakening bearish pressure. Fundamental factors including Fed rate cuts and growing cloud mining adoption provide additional support.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $119.34 | Bullish |

| 20-Day MA | $114.31 | Support |

| Bollinger Upper | $120.61 | Resistance |

| MACD | -2.98 | Improving |

BTCC financial analyst Robert suggests 'While immediate resistance sits around $120.61, breaking this level could open the path toward $130-135 in the near term, supported by both technical momentum and favorable market conditions.'